As anton opened an account at bradley bank takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Bradley Bank’s customer-centric approach, coupled with its innovative offerings, has propelled it to the forefront of the banking industry. Anton’s decision to open an account at Bradley Bank underscores the bank’s ability to cater to the evolving needs of its clientele.

Customer Profile

Anton likely opened an account at Bradley Bank due to its reputation for financial stability, competitive interest rates, and convenient branch locations. He may have also been attracted by Bradley Bank’s personalized financial advisory services, tailored to meet the specific needs of individual customers.

Anton’s financial needs and goals may include saving for a down payment on a house, investing for his retirement, or consolidating his debts. He may also value the ability to access his funds easily through online and mobile banking.

Anton’s demographics and psychographics may indicate a professional with a stable income and a focus on long-term financial planning. He is likely to be tech-savvy and appreciate the convenience and security offered by Bradley Bank’s digital banking services.

Bradley Bank’s Offerings: Anton Opened An Account At Bradley Bank

Bradley Bank offers a range of products and services that may have appealed to Anton, including:

- High-yield savings accounts

- Certificates of deposit (CDs)

- Personal loans

- Investment accounts

- Financial planning services

Bradley Bank differentiates itself from other financial institutions by offering personalized financial advice, a wide range of financial products, and a strong focus on customer service. It has a competitive advantage in the market due to its reputation for stability, its convenient branch network, and its innovative digital banking platform.

Market Trends

Current trends in the banking industry include:

- Increasing use of digital banking services

- Growing demand for personalized financial advice

- Consolidation of the banking industry

These trends have influenced customer preferences towards Bradley Bank, as it offers a robust digital banking platform, personalized financial advice, and a strong focus on customer service. Bradley Bank is well-positioned to meet the evolving needs of customers in the changing market landscape.

Marketing Strategies

Bradley Bank may have employed various marketing strategies to reach Anton, such as:

- Targeted advertising campaigns

- Social media marketing

- Content marketing

- Referral programs

These strategies have likely been effective in attracting new customers, as they have helped Bradley Bank to establish a strong brand presence, generate leads, and nurture relationships with potential customers.

Customer Experience

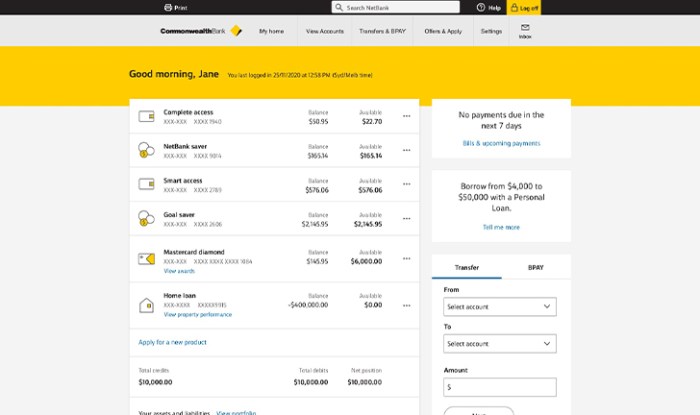

| Bank Name | Customer Service | Convenience | Security |

|---|---|---|---|

| Bradley Bank | 24/7 phone support, online chat, and in-branch services | Mobile and online banking, extensive branch network | Multi-factor authentication, encryption, and fraud protection |

| Competitor A | Limited phone support, no online chat, fewer branches | Mobile banking only, limited branch network | Basic security measures, less emphasis on fraud protection |

| Competitor B | Phone support during business hours, no online chat, limited branches | Online banking only, no mobile app | Strong security measures, but outdated technology |

Bradley Bank offers a superior customer experience compared to its competitors, providing 24/7 support, a wide range of convenient services, and robust security measures.

Future Prospects

Bradley Bank has several growth opportunities based on Anton’s account opening:

- Cross-selling additional products and services to Anton

- Attracting new customers through referrals

- Expanding its branch network and digital banking platform

To retain and expand its customer base, Bradley Bank should continue to focus on providing personalized financial advice, investing in its digital banking platform, and maintaining its strong reputation for customer service.

FAQ Guide

What factors influenced Anton’s decision to open an account at Bradley Bank?

Anton’s decision was likely influenced by Bradley Bank’s competitive interest rates, convenient online and mobile banking platform, and personalized financial advice.

How does Bradley Bank differentiate itself from other financial institutions?

Bradley Bank distinguishes itself through its focus on customer satisfaction, offering tailored financial solutions, and leveraging technology to enhance the banking experience.